Whilst undoubtably there is some negative news within the UK automotive sector at present, it is imperative to allow the investigation to run its natural course. The regulator has been focusing on two specific areas:

– discretionary commission arrangements (DCA)

– borrowers in financial difficulties (BiFD)

I have spent 27 years in automotive, a small stint in new business but predominately collections. I have witnessed the industry improve significantly over this time. Have we got things wrong along the way, yes, but there have been huge strides and attitude towards improvement. The industry is completely committed to achieving the right outcomes for customer’s. I personally have championed Collections departments to have equal parity in business (as for years they have been the poor relation) and now I can honestly say that we are definitely now equal in the room!

The sector continues to learn on the job, is embracing change and therefore we should look at the glass being half full, not have empty!

Guidance for lenders has been taken from CONC 7, TCF 6 Outcomes, BiFD and Consumer Duty. In applying these principles, into operational methodology, it has naturally taken time to adapt through into in-life operational channel. I work with many companies in advising how to better improve current collections and recoveries workflow. I am consistently impressed by all the companies I have consulted with, in how they want to embrace regulation, apply it and are fully committed to reaching the right outcomes for its customers. This is very different to 1997, when I started out in my collectors career!

Working within the non-regulated sector, Forecourt Funding is not involved in any DCA or BiFD regulatory review. That said, we are not immune from it, as it affects our dealers and automotive financiers. The experience of our team is predominately from a regulatory background and therefore we benefit immensely from that invaluable experience, interpretation and being able to read the room. We impart that knowledge into our customer journey and working partnerships.

On providing our dealers with bespoke finance facilities, we assist in expanding their business for growth. These tailor made packages help you grow your business, whilst supporting you in the driving seat. You make the decision on the direction of your business, that is reflected in the way in which we work and support you.

Why not get in touch with our dedicated support team to see how we could help your dealership today?.

Richard comments on article -

"Auto Trader figures point to a positive start to Q2 this year with April marking a significant upswing in consumer demand, transactions, and retail prices, signalling a positive shift after a challenging period. This along with other data from CAP HPI and Dealer Auction reflects a robust market for used cars"

Richard comments on article -

"The slow down in new car production in the previous 3-4 years is now being seen in the used car market, with the average age and average mileage increasing year on year per data released by Dealer Auction. Other stats show a positive start to the year with the number of bids being 19% higher and CAP clean also being up c.1% from Q4 2023."

Richard comments on article -

"Figures released from Motors support the previously noted trend of improved stock turn in the motor trade. Franchise dealers saw an improvement of 5 days whilst independents saw average stock turn improve by 7 days from February to 49 days. Overall, cars in the £10-15k bracket sold the quickest with only a modest 0.6% average drop in retail prices noted on the Motors platform. This is 9% down when comparing YoY but reflecting a steadying of this price adjustment that has been happening throughout the last quarter."

Richard comments on article -

"Positive news coming from Auto Trader with consumer demand increasing by 6% in March (year on year) resulting in record speed of stock turn with an average of just 25 days. This news is further boosted by stable stock prices through the month so a great time to be looking to stock your forecourt and capitalise on this increased demand"

Richard comments on this article -

"Figures from SMMT show that the 2nd hand car market increased by 5.1% in 2023 (based on number of transactions) with the Ford Fiesta retaining its title as the most popular used car. The majority of the top 10 selling cars were small or medium sized hatchbacks, with petrol and diesel still dominating sales, although indications are that there is demand for electric and hybrid vehicles but work needs to be done to make them more attractive to buyers, including better access to charging and tax benefits for new EVs."

Richard comments on this article -

"Figures from Startline show that the recent drop in used car prices has created more potential demand with 21% of motorists asked said this made them much more likely to buy a car whilst a further 25% suggested I slightly increased the likelihood of a purchase. Despite these positive responses 48% of people asked were unaware of the changes in car prices and a further 7% said they needed to drop much further to tempt them into a purchase."

Richard comments on this articles -

"It is commonly known that vehicle prices vary across the UK and the AA have released the list of best value places for car sales, having rated on price, age and mileage (3 of the main factors buyers look at when choosing a car), with each given equal weighting to compile the list. Salford came out on top this year, with Worthing coming in 2nd place, with towns and cities in Scotland and NI both featuring in the top 20"

Richard comments on article -

"The UK used car market ranks ahead of Europe and the US in regards to transparency claims an interesting report released by carVertical."

Richard comments on this article -

"The fall in used cars prices seen towards the end of 2023 was halted in January according to CAP HPI with a minor 0.1% decrease in average prices, compared to a significant 10.5% decline between October and December. Even more positively figures suggest that for the 2nd half of the month many models saw a price increase so hopefully this trend continues into February and we see a period of stability to start this year"

Richard comments on this article -

"Research from Close Brothers Motor Finance suggest that up to 67% of dealers are looking to boost their stock levels this year, with a 3rd also looking to invest in online and their showrooms."

Richard comments on this article -

"Despite the well publicised dip in used car values on the lead up to Christmas as number of models more than held their value, and in fact saw a substantial increase in their value (compared to 2022). Figures released by Motorway show the 10 vehicles that saw the largest increase in value with the list being dominated by SUV’s and small hatchbacks with the electric BMW i3 seeing the largest increase of 33%"

Richard comments on this article -

"Despite many market trends showing the popularity of SUV’s, the supermini was the most popular car type in 2023 and accounted for almost a 3rd of all used car sales and helped the used car market increase by 5.1% in 2023 according to figure released by the SMMT. The Ford Fiesta, Vauxhall Corsa and VW Golf were the top 3 selling models in 2023"

Richard comments on this article -

"Just driving around it is obvious that there is a huge demand and popularity for SUV type vehicles and this is verified by figures from Car Gurus, who confirm that SUV’s have increased by 430% since 2000 with 159 different models to choose from compared to just 30 back in 2000. This resulted in 7 of the top 10 selling vehicles in 2023 being classed as an SUV"

Richard comments on this article -

"Figures from AutoTrader back up the figures from Motorway stating that whilst used car values did drop throughout 2023 a number of models more than held their value as reported by Motor Trader. Auto Trader have released lists of the top 10 cars that saw their values increase, as well as the 10 that saw the biggest decrease (average Jan 24 prices compared to average Jan 23 prices). Interestingly the values quoted differ somewhat with Motorway with the BMW i3 coming in 3rd on the contraction list, whilst topping the list on Motorway which highlights a difference in retail value (as depicted on Auto Trader where cars are sold to the public) and Motorway where dealers are bidding to buy cars, normally at trade value."

Richard comments on this article -

"Despite continued pressure pulling down used car prices January saw solid industry performance with both transactions and consumer demand seeing growth during the month. However, Auto Trader figures show that a significant number of vehicles remain underpriced on their platform, which could equate to c.£30m of potential profit being missed out on by dealers"

Richard comments on this article -

"Figures from BCA show that prices paid for used cars increased in January with a significant increase in volumes compared to December (a typical seasonal trend) but also the final week of the month seeing the highest number of weekly transactions for the auction giant in nearly a year. All in all a positive start to the year"

Richard comments on article -

"Research from Motors shows that car buyers are being more savvy and spending more time researching their next purchase across multiple sites and platforms before committing to a purchase. Whilst many buyers still want to see the car, and drive the car before purchasing these figures show that having a good online presence is essential in the current market"

Richard comments on this article -

"Auto Trader figures for January show that due to robust demand exceeding supply there is a high number of vehicles being underpriced on their platform. Figures show that 47,500 cars are currently being advertised below their market average price which is creating a discrepancy between trade and retail valuations, which in turn could be creating an opportunity for retailers to take advantage of."

Richard comments on this article -

"Research from the AA finds that 31% of car buyers have purchased 2 or 3 cars from the same dealer highlighting that loyalty remains a important factor in running a successful dealership. Further insights into customer habits highlight over half of buyers look into the business and note any accreditations and reviews for the business before committing to any purchase"

Richard comments on this article -

"Recent research from Startline suggests dealer confidence is improving in regards to availability, value and condition of used stock"

Richard comments on this article -

"Following noted drops in used car values in the last quarter January is seeing an element of stabilisation per figures released by CAP HPI although they do predict further reductions in average used price values in the coming weeks, albeit small ones. The key remains knowing your core market as certain models are seeing increases whilst others continue to see larger decreaseshttps://www.am-online.com/news/market-insight/2024/01/16/used-car-values-stabilise-in-january"

Richard comments on this article -

"Auto Trader figures from December highlight pockets of growth and improved profitability in the used car markets, however this is not across all age ranges or classes. Cars between 5-10 years old saw a small 0.7% decreases with cars aged between 10 and 15 years seeing a far larger 7.4% dip, with an increase in supply exceeding the demand being highlighted as the cause. However, year on year figures show that 10-15 year old vehicle values are up by 5.3%, suggesting the recent dips are more of an alignment than a concern. Based on these figures and the overall annual trend Auto Trader is predicting a small market uplift in 2024"

Richard comments on this article -

"December marked the 4th consecutive month of price decreases on used cars according to data released by Auto Trader. However, these figures also highlight a continued disparity in the level of decreases by vehicle type, with EV’s seeing a far larger decrease (both year on year and month on month) than either petrol or diesel vehicles. Is this a sign that the used EV market is settling down, with used EV’s slowly becoming more affordable, or is it demand for these remains low?"

Richard comments on this article -

Recent research by the Energy and Climate Intelligence Unit (ECIU) indicates that petrol cars cost on average £700 per year to run than an EV. This claim takes into consideration charging/fuelling costs as well as servicing. Despite this, EV sales remain very low with most drivers being put off by the higher purchase cost of the vehicle with the AA claiming ‘range anxiety’ is becoming less of an issue as the UK charging network continues to improve. Research by Goldman Sachs predicts that the cost of the battery for an EV will decrease by up to 40% by 2025, which could make an EV purchase more desirable for more customers in the coming years

Richard comments on this article -

SMMT release data showing the most popularly sold used cars in 2023 (up to end of Q3) with small hatchbacks claiming th top 3 spots with the Ford Fiesta coming out top by some margin (more than 50,000 more units than the 2nd place Vauxhall Corsa). This data backs up other reports that show the demand for smaller, cheaper vehicles remains high in this challenging economic climate

Richard comments on this article -

Stock up and start advertising your vehicles now is the message to be taken from recent data released by Motors. Historically, online searches increase immediately after Christmas and the volume then continues to grow into January as people start to think about their next vehicle purchase. Purchasing and advertising stock now ensures that you do not miss out on any sales opportunities and ensure you start 2024 on a positive

Richard comments on this article -

AM hosted a very interesting panel discussion focussing on the use of data in the used car market. Whilst the panellists were all talking from a car supermarket viewpoint, many of the discussion points are relevant to all dealers regardless of size. Knowing your market, monitoring what is selling well (both quickly and with good profits) and tailoring your buying to these trends is essential to being successful. This is especially the case with what is still a relatively volatile market with regular valuation swings which are sometimes difficult to predict. Our funding platform allows you to see exactly how long a vehicle has been funded to help give you this important insight for your business

Richard comments on this article -

Auto Trader figures show good levels of growth across all sectors of the used car market compared to 2022 figures. This is very positive news, especially as we head into a typically quieter period around Christmas. Car values, despite a recent dip, remain generally above 2022 figures with cars over 5 years showing a 2.2% increase, and cars over 10 years old showing on average an increase of 8.4%. Whilst the good news on slightly older cars, used cars less than 5 years old saw an average decrease of 4.5% YoY, influenced by an influx of cars into the market in recent months. Overall though, the figures published paint a positive outlook for the used car market and again highlights the need to know your target market and to buy and stock accordingly.

Richard comments on this article -

BCA announce an experimental physical auction at it's Nottingham site in December, 3 years after moving to purely online. This follows other auction houses, including G3 who have been operating physical auctions alongside an online option for a number of years and many dealers feeling it is much better to attend a physical auction to see the vehicle, especially if dealing in lower value, slightly older vehicles

Richard comments on this article -

Figures from Auto Trader show that overall used car prices dropped in November. However, this was driven by cars less than 5 years old, with cars over 10 years seeing prices up by 7% year on year. Whilst the trend appears to be prices dropping this needs to be taken into context, with prices still being c.39% more than they were pre-pandemic in November 19

Richard comments on this article -

"BCA figures for October show an increased mix of used stock hitting the market which saw overall values increase by 1.8% during the month, despite a 4.2% decrease in price guides during the same period. An improved supply of new vehicles to the market is definitely causing a bit of a shake up and realignment of used car values with BCA also advising that the reemergence of discounting on new vehicles is having a further impact on the used market."

Richard comments on this article -

"Dealer Auction’s October Retail Margin Monitor is released and includes a range of manufacturers, with Land Rover topping the list, and Toyota coming in at number 10, appearing on the list for the first time since the list was created in January 22. Other premium brands such as BMW, Mercedes and Audi also feature in the list along with Volvo, MINI, Mazda, Kia and VW. Despite Hyundai not appearing in the manufacturers list, the Hyundai Tucson comes in at number 5 on the list by model, with an average margin of £3,300 and an average stock turn of 37 days"

Richard comments on this article -

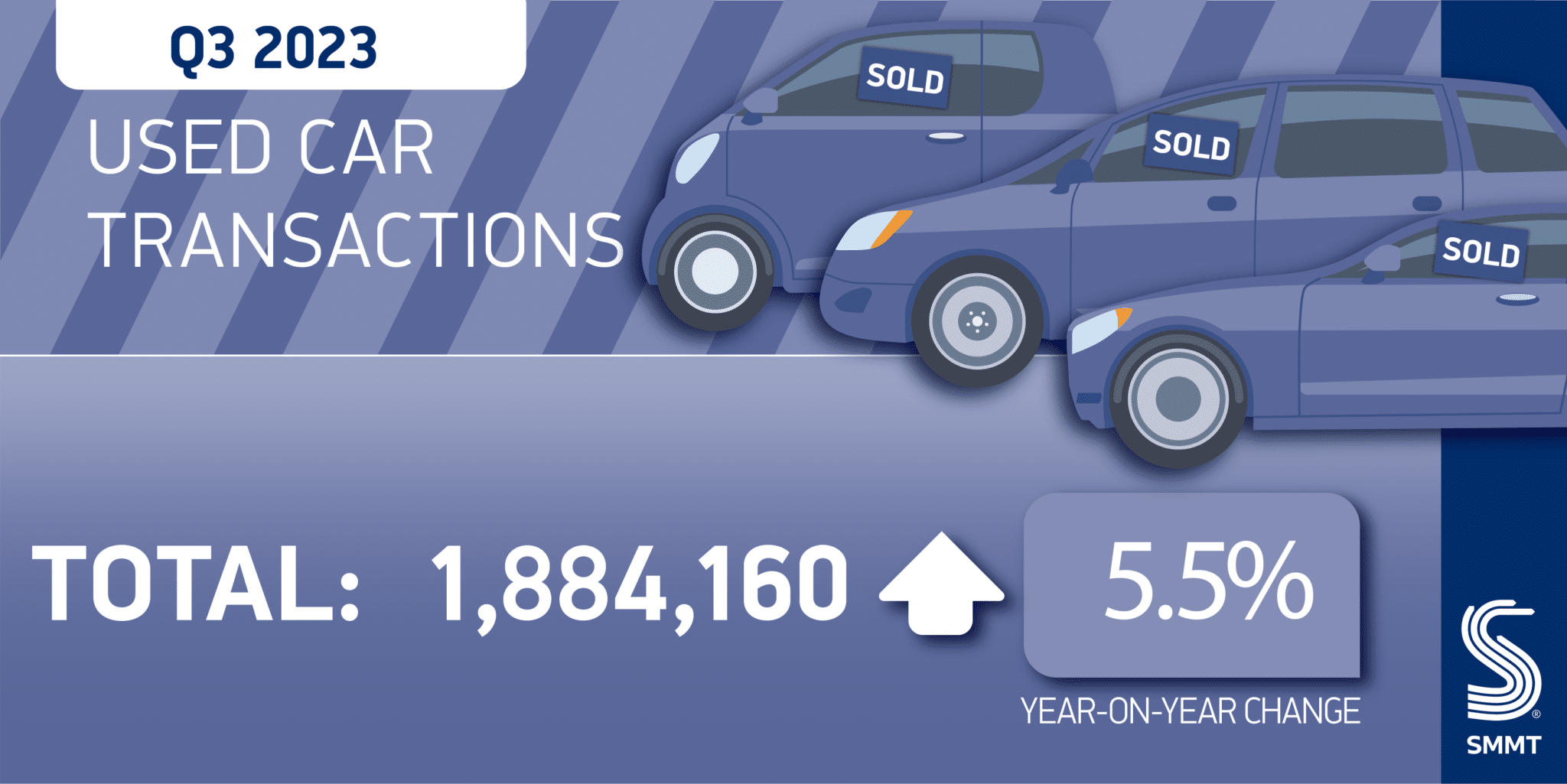

"Latest figures released by SMMT show that Q3 was a strong quarter for used car sales with growth of 5.5% noted. The most interesting stat is that all car types (ICE, BEV's, PHEV's and HEV's) all showing growth with BEV's showing growth of almost 100% (although still a modest 1.8% of the market), PHEV's up 34.6%, HEV's up 46.4%, petrol up 4% and Diesel up 2.3%. Whilst ICE vehicles still dominate the market, do these figures show that buyers habits are changing and more people are accepting of the hybrid vehicle as a soft landing towards electric? Interesting to monitor these figures going forward"

Richard comments on this article -

"The continuing cost of living crisis is still being felt with half of surveyed customers expressing concern at the affordability of car finance. The survey commissioned by Alphera Financial Services highlights a wide range of expectations emphasising the importance of fair value and transparency, in line with new Consumer Duty."

Richard comments on this article -

"The AA announce that their research shows that 7 of the 10 most popular searched for used cars have increased in value in the last 2 years, despite being older. Models such as the Toyota Aygo, Vauxhall Corsa and VW Polo have all seen increases of between 8 and 16% during this period."

Richard comments on this article -

"A rapidly changing market place means staying close to the value of your assets is essential to ensure you maintain a sufficient profit margin. CAP HPI advise that used vehicle values have dipped by 1.5% in the 2 weeks since their editorial on 27th October, which follows the 4.2% dip noted in the previous month. This is again being viewed as a continued market realignment following previous boom periods rather than a concern."

Richard comments on this article -

"eBay Motors Group announces that negotiating a fair price with dealers is their biggest worry when purchasing a car. Other areas highlighted are understanding finance and getting the most out of test drives"

Richard comments on this article -

"September's annual plate change saw an influx of stock into the used car market, without having a negative impact on prices with both prices and demand remaining stable according to eBay Motors Group"

Richard comments on this article -

"CAP HPI advise that used car prices saw a significant drop in prices in October, however they advise this is more of a further alignment than a crash, partially driven by the increase in available stock in the market"

Richard comments on this article -

"FCA looking into the sale of GAP Insurance and considering a ban from selling this product at point of sale"

Richard comments on this article -

"Lexus and Toyota top the What Car? poll for the most reliable used car (up to 5 years old)"

Richard comments on this article -

"The UK government releases their mandate for zero emission vehicles in line with the revised 2035 target"

Richard comments on this article -

"Forecasters predict a decrease in used stock availability but that the used car market will be sustained by core needs purchases"

Richard comments on this article -

"CAP HPI figures show that used car prices fell in September, but director of valuations advises that this is a gentle realignment rather than a crash"

Richard comments on this article -

"eBay Motors show the Tesla Model 3 was the fastest selling used car in September, but petrol vehicles still accounted for over half of all used vehicle sales."

Richard comments on this article -

"Automatic vehicles dominate up to 69% of used cars on sale in parts of the UK, fuelled by the rise of Electric Vehicles (EVs) and a decline in the number of manuals being manufactured, according to new research from the AA Cars used car website"

Richard comments on this article -

"CAP HPI predicting a small dip in used car prices throughout September reflecting an improved availability of new cars to market"

Richard asks - " Do you agree that the target was unachievable and more support from the government is required to achieve the aims?"

Richard comments on this article -

"1 in 5 car owners aged between 25-34 claim to be selling their car per a recent survey. How many of these are downsizing the car is not declared, but this mirrors previous trends highlighting the increased demand in slightly older and cheaper cars as people adjust to the cost of living crisis"

Richard comments on this article -

"Independent car dealers stock more cars aged 10 years and older as stock availability of newer cars forecast to challenge car supermarkets"

Richard comments on this article -

"July saw a decrease in volume of motor finance deals with forecasts indicating a drop of c.6% in 2023 for used car finance. Is this another reflection of the preference for older, cheaper cars?"